Defining Corporate Finance Corporations and Their Role in Investments

Corporate finance corporations play a crucial role in facilitating investment opportunities, acting as intermediaries between investors and businesses seeking capital. They leverage their expertise in financial markets and corporate strategy to structure and execute investments, ultimately driving economic growth. Understanding their diverse functions and approaches is essential for both investors and businesses seeking funding.Corporate finance corporations offer a range of services tailored to specific investment needs.

Their involvement spans various stages of the investment lifecycle, from initial deal sourcing and due diligence to post-investment monitoring and exit strategies. This multifaceted approach ensures a comprehensive and professional management of investments.

Types of Corporate Finance Corporations

Corporate finance corporations can be broadly categorized based on their size, focus, and investment strategies. Some specialize in mergers and acquisitions (M&A), others in private equity, and still others in public market investments. These specializations often reflect differing risk appetites and investment horizons. For example, private equity firms typically hold investments for longer periods, aiming for significant value appreciation through operational improvements, while hedge funds may employ shorter-term strategies focusing on market arbitrage or short-selling.

Investment banks, on the other hand, often facilitate transactions across various asset classes, acting as advisors and underwriters.

Services Offered to Investors

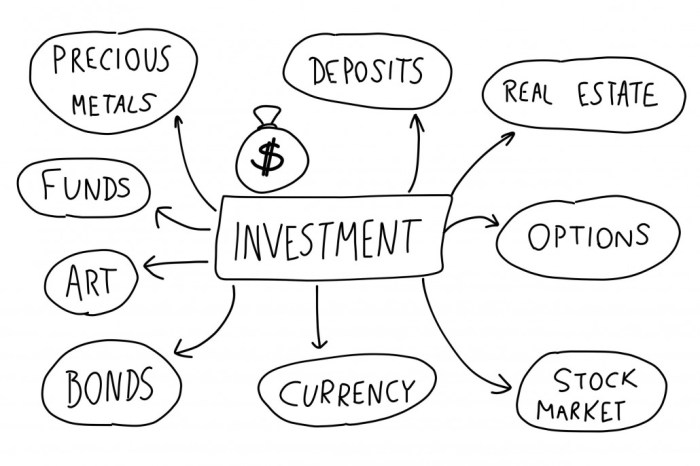

A wide array of services is typically provided by corporate finance corporations to investors. These include: investment banking services (advisory on mergers, acquisitions, and divestitures), underwriting (issuing securities on behalf of companies), portfolio management (managing investment portfolios for institutional and high-net-worth clients), private equity investments (investing in privately held companies), and research and analysis (providing market research and investment recommendations).

The specific services offered will depend on the corporation’s specialization and the investor’s needs.

Examples of Successful Investment Strategies

Successful investment strategies employed by corporate finance corporations are often characterized by rigorous due diligence, a clear understanding of market trends, and a proactive approach to risk management. For instance, some firms have successfully invested in disruptive technologies, anticipating significant future growth. Others have focused on undervalued assets in specific sectors, capitalizing on market inefficiencies. A notable example is the successful investment strategy of Berkshire Hathaway, known for its long-term value investing approach and focus on high-quality businesses.

Their long-term holdings in companies like Coca-Cola and American Express exemplify this strategy. Another example could be a private equity firm’s successful turnaround of a struggling manufacturing company through operational restructuring and strategic acquisitions.

Comparison of Investment Approaches

Different corporate finance corporations employ diverse investment approaches, reflecting varying risk tolerances, investment horizons, and areas of expertise. Some focus on growth investing, seeking high-growth companies with significant expansion potential. Others may favor value investing, targeting undervalued companies with strong fundamentals. The investment approach also varies significantly across asset classes. For instance, a real estate investment trust (REIT) will employ a vastly different investment strategy compared to a venture capital firm focused on early-stage technology companies.

The comparison hinges on several factors, including the type of asset, the investment timeline, and the risk profile. These differences ultimately shape the returns and risk profiles associated with investments managed by these corporations.